US Dollar Index faces some downside pressure around 100.70

- DXY corrects lower following recent tops above 101.00.

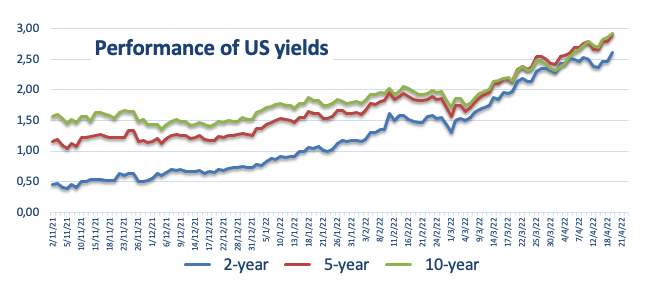

- US yields also recede from earlier highs and trade on the defensive.

- Fedspeak, housing data next on the US calendar on Wednesday.

The greenback, when tracked by the US Dollar Index (DXY), extends the corrective downside to the 100.70 region midweek.

US Dollar Index capped by the 101.00 area

The index comes under pressure and trades in the negative territory following four consecutive daily advances on Wednesday.

The corrective move in the buck comes amidst the equally negative performance in US yields on the back of a tepid recovery in the bonds market. Furthermore, yields along the curve ease some upside momentum after hitting fresh cycle highs on Tuesday.

No news from the war in Ukraine should leave the downside in the dollar somewhat contained for the time being.

In the US docket, usual weekly Mortgage Applications tracked by MBA are due seconded by Existing Home Sales and speeches by San Francisco Fed M.Daly (2024 voter, hawk) and Chicago Fed C.Evans (2023 voter, centrist).

What to look for around USD

The dollar’s rally surpassed albeit ephemerally the 101.00 mark in the first half of the week, although it came under some selling pressure afterwards. So far, the greenback’s price action continues to be dictated by the likeliness of a tighter rate path by the Fed and geopolitics. In addition, the case for a stronger dollar also remains well propped up by high US yields and the solid performance of the US economy.

Key events in the US this week: IMF World/Bank Spring Meetings, Existing Home Sales, Fed Beige Book (Wednesday) - IMF World/Bank Spring Meetings, Initial Claims, Philly Fed Index, Fed Powell (Thursday) - IMF World/Bank Spring Meetings, Flash Services/Manufacturing PMIs (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is retreating 0.29% at 100.70 and faces initial contention at 99.57 (weekly low April 14) followed by 97.68 (weekly low March 30) and then 97.15 (100-day SMA). On the flip side, the breakout of 101.02 (2022 high April 19) would open the door to 101.91 (high March 25 2020) and finally 102.99 (2020 high March 20).