GBP/USD Price Analysis: Bulls need validation from 1.3450 immediate hurdle

- GBP/USD grinds higher after posting the biggest daily gains in a month.

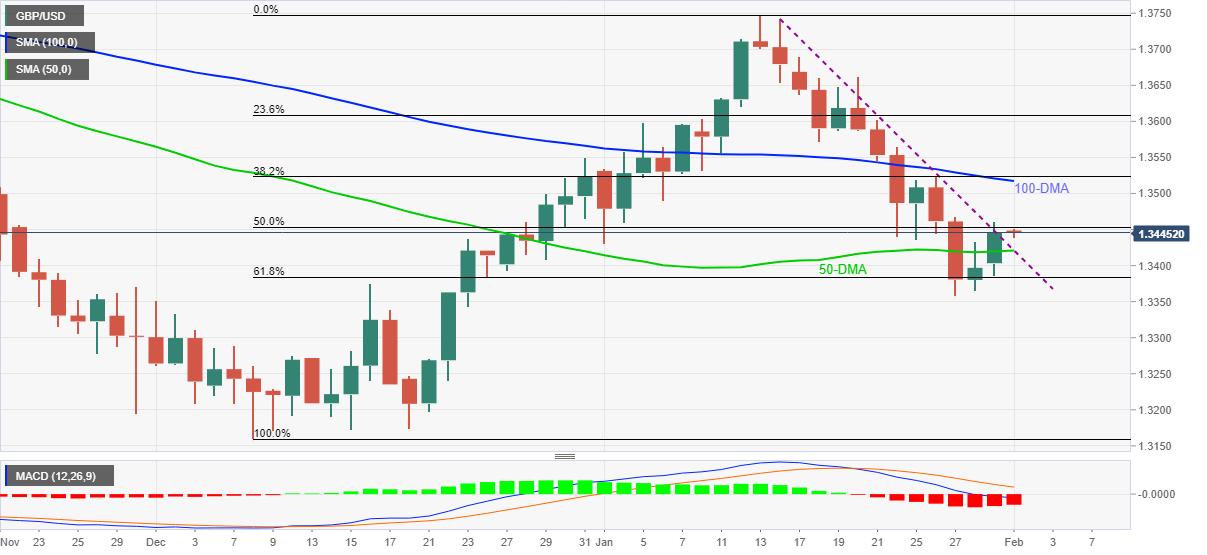

- A confluence of 50-DMA, fortnight-old descending trend line restricts short-term downside.

- 50% Fibonacci retracement guards immediate upside ahead of 100-DMA.

GBP/USD holds onto the previous day’s resistance break around 1.3440-45 during a quiet start to Tuesday’s Asian session.

The cable pair rose past a downward sloping trend line from January 14 following its bounce off the 61.8% Fibonacci retracement (Fibo) of December 2021 to January 2022 upside.

However, the 50% Fibo. level guards the quote’s further advances around 1.3450, a break of which will direct the GBP/USD prices towards the 100-DMA level of 1.3517.

It’s worth noting that the 1.3500 threshold will act as an intermediate halt whereas the 1.3600 round figure may lure GBP/USD bulls past 1.3517.

Meanwhile, a convergence of the 50-DMA and resistance-turned-support line near 1.3420 becomes the key nearby support to watch during the quote’s pullback moves.

Following that, the 61.8% Fibonacci retracement level and the recent swing low, respectively around 1.3385 and 1.3355, will challenge the GBP/USD sellers.

Overall, GBP/USD prices have recently crossed a short-term key hurdle and hence may witness further recovery.

GBP/USD: Daily chart

Trend: Further upside expected