Back

19 May 2021

Crude Oil Futures: Further downside in the pipeline

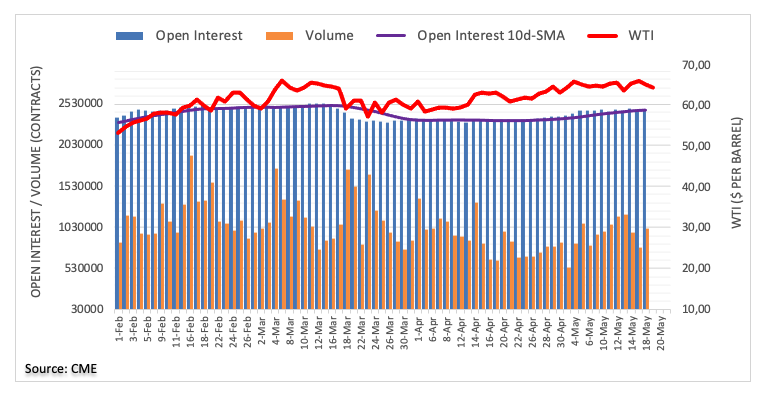

CME Group’s flash data for Crude Oil futures markets showed traders increased their open interest positions by more than 9K contracts on Tuesday, extending the erratic activity seen as of late. Volume followed suit and went up by around 240.4K contracts after two daily pullbacks in a row.

WTI risks extra losses

Prices of the WTI started the week on a negative footing against the backdrop of rising open interest and volume, allowing for the continuation of the corrective downside in the very near-term. That said, the leg lower could extend initially to recent lows around the $63.00 mark per barrel.