Gold Price Analysis: XAU/USD down but not out, support is firm – Confluence Detector

Gold has been on the back foot in a counter-move to last week's Fed-fueled surge. Markets are taking profits on XAU/USD longs and on dollar shorts. Nevertheless, the fundamental picture remains positive for the pressure metal.

The Federal Reserve is on course to leave interest rates lower for longer, prioritizing employment and allowing inflation to overheat if necessary. The next leg higher for gold could come from the approval of a new fiscal package.

In the meantime, how is XAU/USD positioned on the charts?

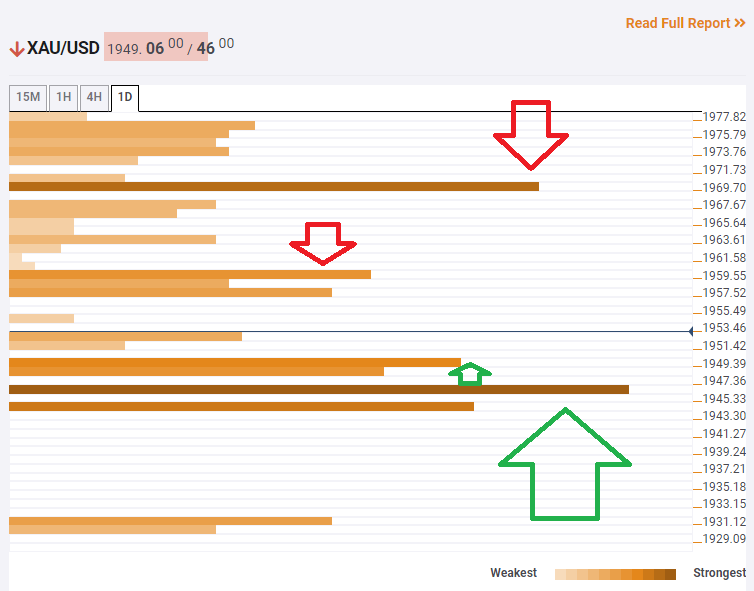

The Technical Confluences Indicator is showing that gold has strong support at $1,946, which is the convergence of the Fibonacci 161.8% one-day, the Simple Moving Average 10-one-day, the Pivot Point one-day Support 2, and more.

That cushion on the downside is more robust than the strongest cluster of visible resistance. At $1,970, XAU/USD faces the meeting point of the Bollinger Band 4h-Middle, the previous 1h-high, and the SMA 100-15m.

A minor hurdle on the way up is at $1,959, which is the confluence of the Fibonacci 23.6% one-week and the BB 1h-Lower.

Near-term support is at $1,950, which is a juncture of lines including the Fibonacci 38.2% one-week and the SMA 50-4h.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence