Gold Price Analysis: XAU/USD faces uphill battle and could fall to $1,906 – Confluence Detector

Gold remains on the back foot as uncertainty remains prevalent ahead of the all-important policy review from the central bank. Jerome Powell, Chairman of the Federal Reserve, is set to deliver a speech that may open the floodgates to more monetary stimulus – potentially pushing the precious metal higher.

However, investors are yet to be convinced that additional money printing is on its way, reducing their bets on XAU/USD.

How is gold positioned on the charts?

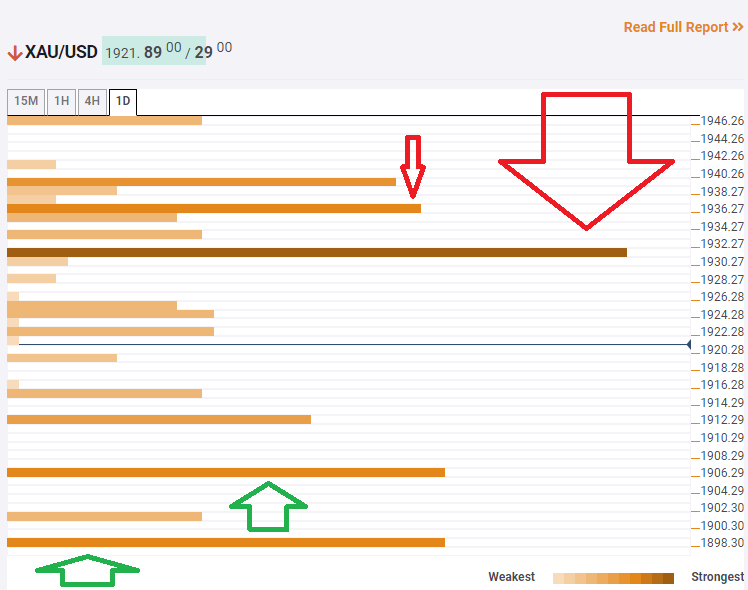

The Technical Confluences Indicator is showing that XAU/USD is facing fierce resistance at around $1,933, which is the convergence of the Bollinger Band 15min-Upper, the Simple Moving Average 5-4h, the SMA 100-15m, the Fibonacci 23.6% one-month, and more.

Further above, gold is capped at $1,936, which is the meeting point of the previous 4h-high and the Fibonacci 23.6% one-week.

Looking down, support awaits at $1,906, which is where the Pivot Point one-day Support 1 and the previous weekly low converge.

Another cushion is at $1,898, which is the confluence of the PP one-day S2 and the Fibonacci 38.2% one-month.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence