US Dollar Index moves back to the 96.30 region

- DXY’s bounce loses momentum I the 96.55/60 band on Thursday.

- Risk-on sentiment continues to rule the global mood.

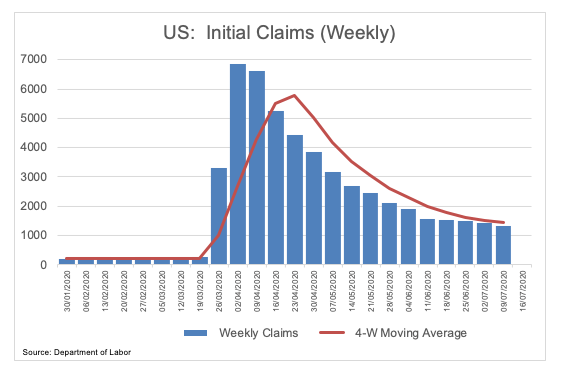

- US Initial Claims came in at 1,314 million during last week.

After a brief rebound to daily tops in the 96.55/60 band, the greenback has now returned to the negative territory near 96.30 when tracked by the US Dollar Index (DXY).

US Dollar Index remains under pressure below 97.00

The demand for the safe haven dollar stays subdued for the second session in a row on Thursday, always against the backdrop of the better sentiment surrounding the riskier assets.

In fact, investors stay vigilant on the developments from what appears to be an incipient second wave of the coronavirus pandemic and its potential impacts on the ongoing re-opening of the global economy. However, this seems to be insufficient to shift the sentiment back to the safe havens as long as market participants remain optimistic on hopes of a strong economic recovery in the months to come.

In the docket, Initial Claims rose more than 1,3 million during last week, bettering consensus although far from bringing any respite to the labour market, which showed that over 18 million Americans are still benefiting from unemployment insurance.

What to look for around USD

The progress of the COVID-19 in the US remains in the centre of the debate amidst efforts to keep the re-opening of the economy well in place. As always, the broad risk appetite trends emerge as the main driver for the dollar in the short-term coupled with omnipresent US-China trade and geopolitical effervescence. On the constructive stance around the buck, bouts of risk aversion should support the investors’ preference for the greenback as a safe haven along with its status of global reserve currency and store of value. Playing against this, the ongoing (and potentially extra) stimulus packages by the Federal Reserve could limit the dollar’s upside.

US Dollar Index relevant levels

At the moment, the index is losing 0.13% at 96.36 and faces the next contention at 96.24 (monthly low Jul.9) seconded by 96.03 (50% Fibo of the 2017-2018 drop) and then 95.72 (monthly low Jun.10). On the other hand, a break above 97.80 (weekly high Jun.30) would aim for 97.87 (61.8% Fibo of the 2017-2018 drop) and finally 98.27 (200-day SMA).