EUR/GBP Price Analysis: Stuck in a symmetrical triangle ahead of the key day

- EUR/GBP remains mildly positive.

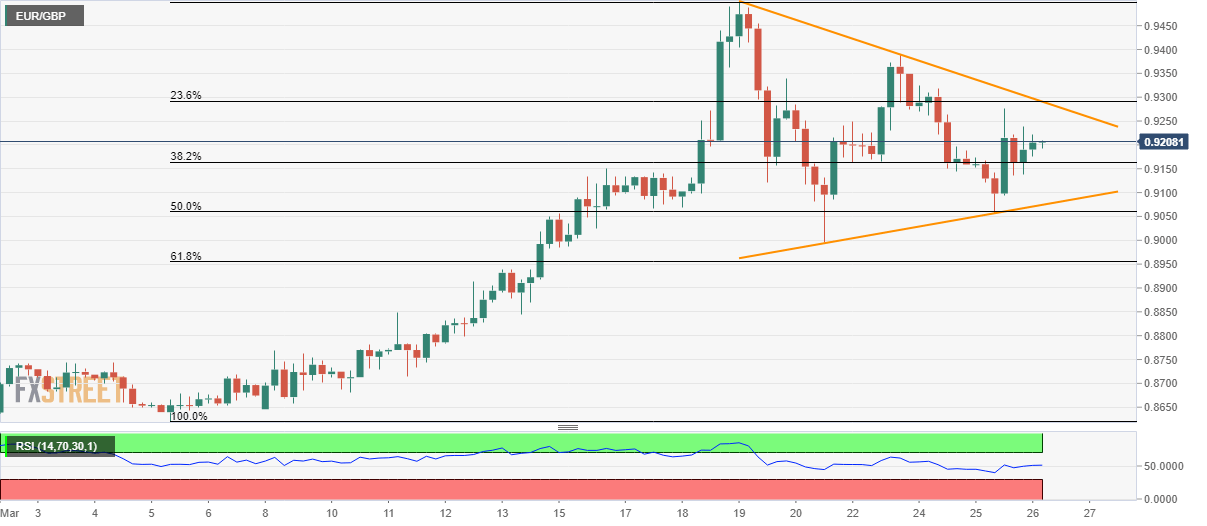

- The weekly triangle formation limits the pair’s moves amid normal RSI conditions.

- G20, BOE, UK Retail Sales and expected stimulus from Europe could offer a volatile day.

EUR/GBP registers 0.40% gains to 0.9200 while nearing the European open on Thursday. The pair portrays a symmetrical triangle formation while observing its one-week moves.

Given the absence of extra-ordinary moves in the RSI, which in-turn could have signaled the pullback, the quote is expected to carry its sideways momentum inside the 220 pips area between 0.9290 and 0.9070.

It should also be noted that 61.8% Fibonacci retracement of the pair’s early-month rise, at 0.8955, adds to the supports whereas Monday’s top near 0.9340 can offer an extra filter to the upside.

On the fundamental side, the receding strength of the pandemic in Italy, in contrast to the outbreak in the UK, might help the regional currency to benefit more from the slightly positive news/events than the otherwise case.

EUR/GBP four-hour chart

Trend: Sideways