EUR/USD challenges 1.13 post-Payrolls

- EUR/USD remains bid above the 1.13 mark on Friday.

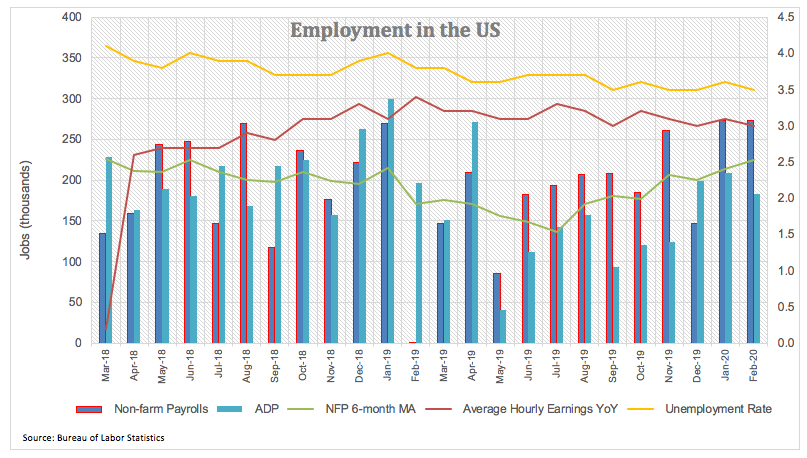

- US Non-farm Payrolls came in at 273K in February.

- The jobless rate ticked lower to 3.5% (from 3.6%).

The buying interest around the single currency stays unaltered at the end of the week, with EUR/USD navigating the area above the key barrier at 1.1300 the figure.

EUR/USD bid despite upbeat Payrolls

EUR/USD has practically ignored the strong results from US Non-farm Payrolls, which showed the economy created 273K jobs during February, surpassing expectations at 175K and matching January’s 273K (revised from 225K).

Additional data showed the unemployment edged lower to multi-decade lows at 3.5% and the critical Average Hourly Earnings – a proxy for inflation via wages – expanding at a monthly 0.3% and 3.0% from a year earlier.

EUR/USD levels to watch

At the moment, the pair is gaining 0.64% at 1.1310 and a break above 1.1340 (2020 high Mar.6) would target 1.1347 (high Jun.13 2019) en route to 1.1412 (monthly high Jun.25 2019). On the flip side, initial contention is seen at 1.1186 (61.8% Fibo of the 2017-2018 rally) seconded by 1.1098 (200-day SMA) and finally 1.1041 (55-day SMA).