Back

7 Feb 2020

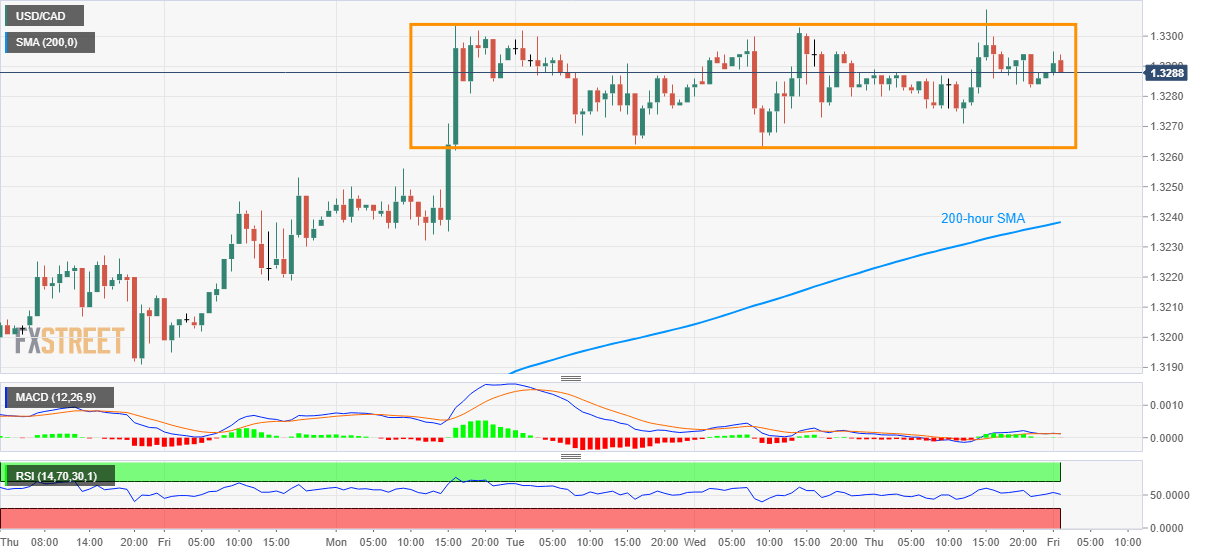

USD/CAD Price Analysis: Choppy inside short-term range

- USD/CAD keeps the three-day-old trading range intact.

- MACD, RSI signal bullish exhaustion.

- 200-hour SMA offers additional downside support, November high could please buyers following the breakout.

USD/CAD remains modestly weak around while taking rounds to 1.3290 during early Friday. Even so, the pair keeps the short-term trading range, between 1.3305 and 1.3260, intact.

It should be noted that RSI and MACD indicate bullish exhaustion and can drag the quote to a 200-hour SMA level of 1.3238 on the downside break of 1.3260.

On the contrary, November month high close to 1.3330, followed by October 2019 top surrounding 1.3350, could please buyers during the upside break beyond 1.3305.

While September 2019 peak around 1.3385 can lure bulls past-1.3350, lows marked during late-January near 1.3190 may flash on the sellers’ radar if the pair remains weak below 1.3238.

USD/CAD hourly chart

Trend: Sideways