USD/JPY continues to rise as risk sentiment remains key

- USD/JPY has pushed higher again today as risk sentiment remains in focus.

- Equities in the EU area are still positive as the FTSE and DAX trade higher.

USDJPY is once again trading higher which could mean a three-day winning streak.

It's hard to say when this will "top out" as the softer trade war stance is really pushing equities higher.

One of the main stories in the macro arena is the softening in stance by almost all the worlds central banks.

This accommodative stance is pushing risk assets like equities higher.

Safe havens such a CHF, JPY and Gold are all grinding lower while some of the commodities currencies are flourishing.

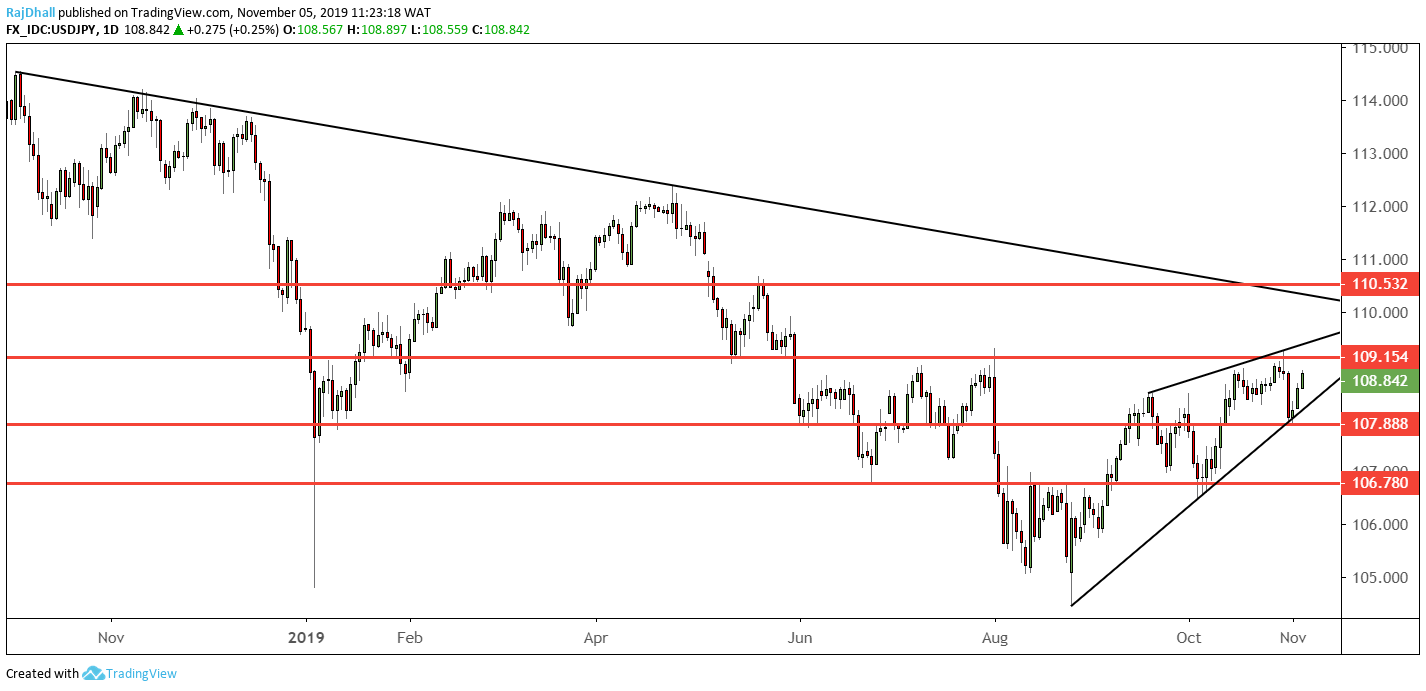

Looking at the chart below, there is a rising wedge formation which USD/JPY is heading to the top of. On Friday there was a decent sell-off but the market failed to sustain this move and the pair has moved right back up. On the top side resistance levels come in to focus and now traders are looking to see if the wave high of 109.28 can be taken out. If it does get broken it would be a very bullish signal for risk.