Gold Technical Analysis: Struggles to gain any positive traction despite risk-off mood

• US-China trade tensions-led global wave of risk aversion trade fail to revive the precious metal's safe-haven demand, with traders even shrugging off a modest USD retracement.

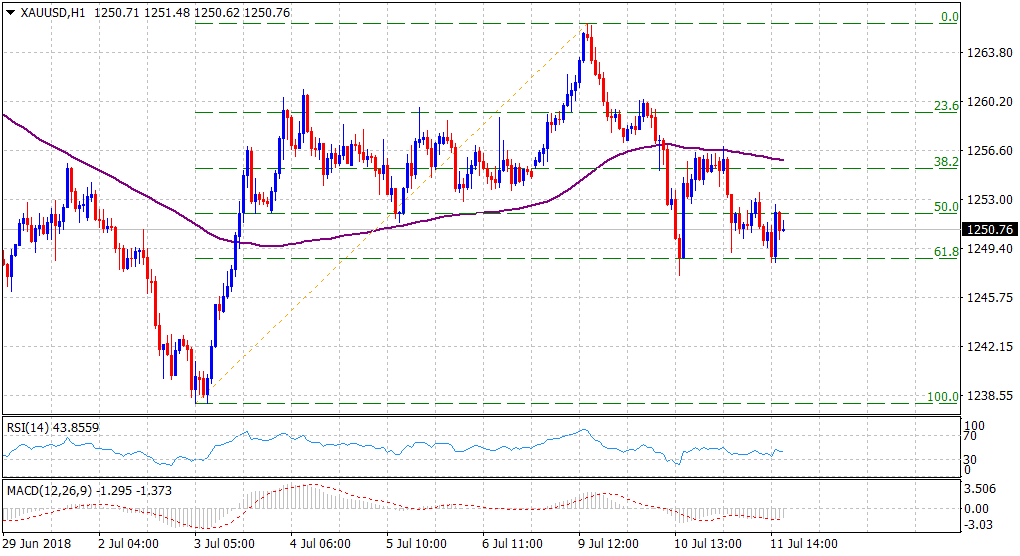

• The fact that overnight recovery attempt was rejected near 100-hour SMA support-turned-resistance points to prevailing selling interest at higher levels, albeit $1248-47 area has been acting as a floor over the past 24-hours.

• With short-term technical indicators holding in negative territory, a follow-through weakness below 61.8% Fibonacci retracement level of the recent recovery move would add credence to the near-term bearish outlook.

Gold 1-hourly chart

Spot Rate: $1250.76

Daily High: $1256.93

Daily Low: $1248.36

Trend: Bearish

Resistance

R1: $1254.50 (horizontal zone)

R2: $1260 (overnight swing high)

R3: $1266 (near two-week tops set on Monday)

Support

S1: $1247 (overnight swing low)

S2: $1242 (recent daily closing low)

S3: $1238 (YTD low set earlier this month)