WTI spikes above $62.00 ahead of rig count

- Prices of WTI leapt to fresh highs beyond the $62.00 mark on Friday.

- The broader consolidative theme still prevails, supported below $60.

- US oil rig count by Baker Hughes next of relevance in the oil-universe.

Prices of the barrel of the American benchmark for the sweet light crude oil are now edging higher, challenging 4-day peaks in the $62.00 neighbourhood.

WTI ignores USD-strength, looks to BH

Prices of the WTI are extending the ongoing broader consolidative theme, paying little attention to the USD-rally and staying vigilant, instead, on the prospects of rising US oil production and supplies, probable trade war and OPEC headlines.

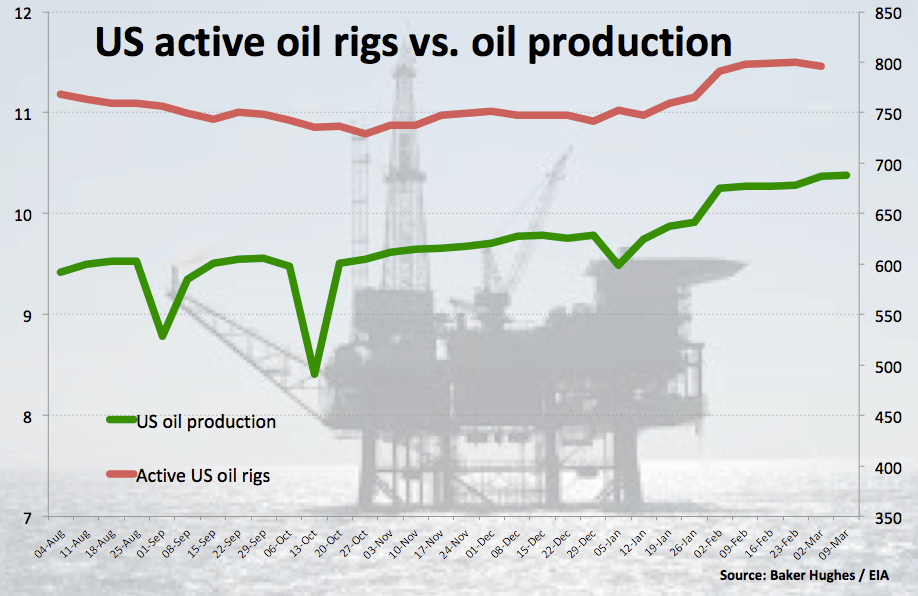

In fact, traders remain concerned after the EIA reported on Wednesday that US crude oil supplies went up by more than 5 mbpd during last week, while production incremented to nearly 10.4 mbpd, all amidst a persistent up tick in US drilling activity.

Adding to the downbeat mood, non-OPEC producers revised higher their forecasts for oil production for this year to 1.6 mbpd vs. 1.4 mbpd previous. Furthermore, the likelihood of a global trade war could impact negatively on crude oil production, all keeping occasional bullish attempts somewhat contained.

On the bright side, the IEA now sees the global demand for crude oil increasing during the next year.

Later in the NA session, driller Baker Hughes will publish its weekly report on US oil rig count (-4 prev.).

WTI significant levels

At the moment the barrel of WTI is up 1.45% at $62.09 facing the immediate hurdle at $62.35 (high Mar.12) followed by $63.31 (high Mar.6) and then $64.30 (high Feb.6). On the other hand, a break below $60.03 (low Mar.8) would target $60.02 (100-day sma) and finally $58.10 (2018 low Feb.9).