When are German IFO surveys and how they could affect EUR/USD?

German IFO Business Climate Overview

The German Ifo surveys for June are lined up for release later today at 8GMT. The headline Ifo Business Climate Index is expected to tick slightly lower to 114.4 in June versus 114.6 seen last month. The Current Assessment sub-index is seen a tad firmer at 123.3 this month, while the Ifo Expectations Index – indicating firms’ projections for the next six months – is expected to edge soften a bit to 106.4 in June, as compared to May’s 106.5 reading.

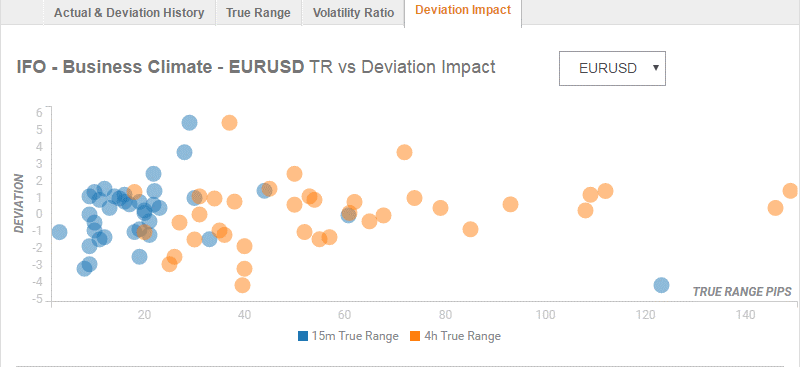

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 3 and 40 pips in deviations up to 2.4 to -3.2, although in some cases, if notable enough, a deviation can fuel movements of up to 60 pips.

How could affect EUR/USD?

The German IFO Surveys are expected to show mixed results across all indicators, which could keep the EUR/USD pair around 1.12 handle, while a better-than expected headline data could send the rate towards mid-1.12s.

Technically, “EUR/USD outlook is neutral to negative: The Euro is seeing a very minor rebound from the 1.1110 end of May low. So far this has been extremely tepid and while capped by the 20 day ma at 1.12014/20 will maintain a negative bias. Rallies will need to regain the 20 day ma at 1.1204 on a closing basis to re-focus attention on the topside and 1.1300. Below 1.1110 should trigger further losses to the 1.1070/23.6% retracement of the move higher this year and then the 55 day ma at 1.1026,” explains Commerzbank Analysts, Karen Jones.

Key notes

Germany: IFO expectations to decline to 106.1 in June – Danske Bank

In the euro area, the German ifo expectation is due for release today and analysts at Danske Bank expect this figure to decline to 106.1 in June.

About German IFO Business Climate

This German business sentiment index released by the CESifo Group is closely watched as an early indicator of current conditions and business expectations in Germany. The Institute surveys more than 7,000 enterprises on their assessment of the business situation and their short-term planning. The positive economic growth anticipates bullish movements for the EUR, while a low reading is seen as negative (or bearish).