USD/RUB flirting with lows near 56.00 ahead of OPEC

The Russian Ruble is posting strong gains vs. its American peer on Thursday, dragging USD/RUB to the area of daily lows in the 56.00 neighbourhood.

USD/RUB all eyes on the OPEC meeting

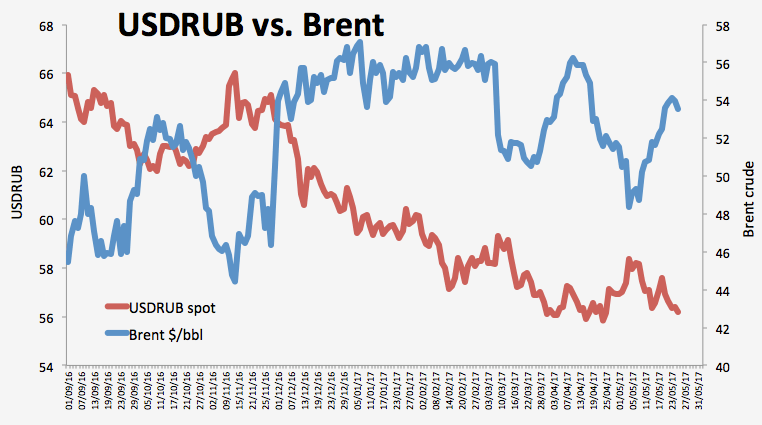

The pair is testing fresh 4-week lows on the back of the rally in crude oil prices, which volatility has increased as of late amidst rising rumours and counter-rumours regarding an extension of the current OPEC/non-OPEC output cut deal, all ahead of the imminent OPEC meeting in Vienna (13GMT).

RUB has been deriving extra support from the upside in the barrel of Brent crude, up nearly 17% since 2017 lows seen earlier in the month in the $46.60 region to peaks in the $54.60/65 band recorded yesterday.

Adding to the pair’s decline, the greenback continues to slide today after the bullish attempt of the US Dollar Index lost vigour in the 97.30 area on Wednesday.

In the Russian data space, the usual weekly report on the FX reserves held by the CBR is due later while earlier in the week Retail Sales came in flat on an annualized basis in April and the unemployment rate ticked lower to 5.3% during the same period.

Back to the US, Initial Claims are due seconded by Wholesale Inventories and the speech by FOMC’s L.Brainard (permanent voter, centrist).

USD/RUB levels to watch

At the moment the pair is losing 0.42% at 56.17 facing the next support at 56.00 (low May 25) followed by 55.67 (2017 low Apr.25) and then 53.03 (low Jun.18 2015). On the other hand, a break above 56.57 (high May 24) would aim for 56.98 (20-day sma) and finally 57.06 (55-day sma).