USD/JPY drops on Bank of Japan headlines

- USD/JPY bears move in on BoJ headlines ahead of US CPI event.

- US Dollar posied technical bullish and USD/JPY also, while above 131.00.

USD/JPY has dropped heavily into the Tokyo open and is down some 0.4%. The pair fell from a 132.48 high to a low of 131.76 before stabilising. Japanese media Yomiuri came out with the news suggesting another hawkish move by the Bank of Japan (BoJ) during its next week’s monetary policy meeting.

The announcement signalled that the Japanese central bank is up for reviewing the side effects of massive monetary easing in the monetary policy meeting next week. “BoJ reviews due to skewed interest rates in markets even after last month's tweak in bond yield control policy,” adds Yomiuri per Reuters.

All eyes on US CPI

This comes ahead of today's US December inflation report, which is expected to show US prices rose by an annualized 6.5%. This is lower than November's 7.1% pace. Investors are monitoring the Consumer Price Index closely as the expectations are that if it were to continue to decelerate, so too will the Federal Reserve's pace of rate hikes.

In this regard, analysts at TD Securities explained that they are looking for the core Consumer Price Index to have edged higher on a monthly basis in December, ''closing out the year on a relatively stronger footing,'' they said.

''Indeed, we forecast a firm 0.3% MoM increase, as services inflation likely gained momentum. In terms of the headline, we expect the Consumer Price Index inflation to register a slight decline on an unrounded basis in December, but rounded up to flat MoM, as energy prices offered large relief again. Our MoM projections imply that headline and core CPI inflation likely lost speed on a YoY basis in December.''

USD/JPY technical analysis

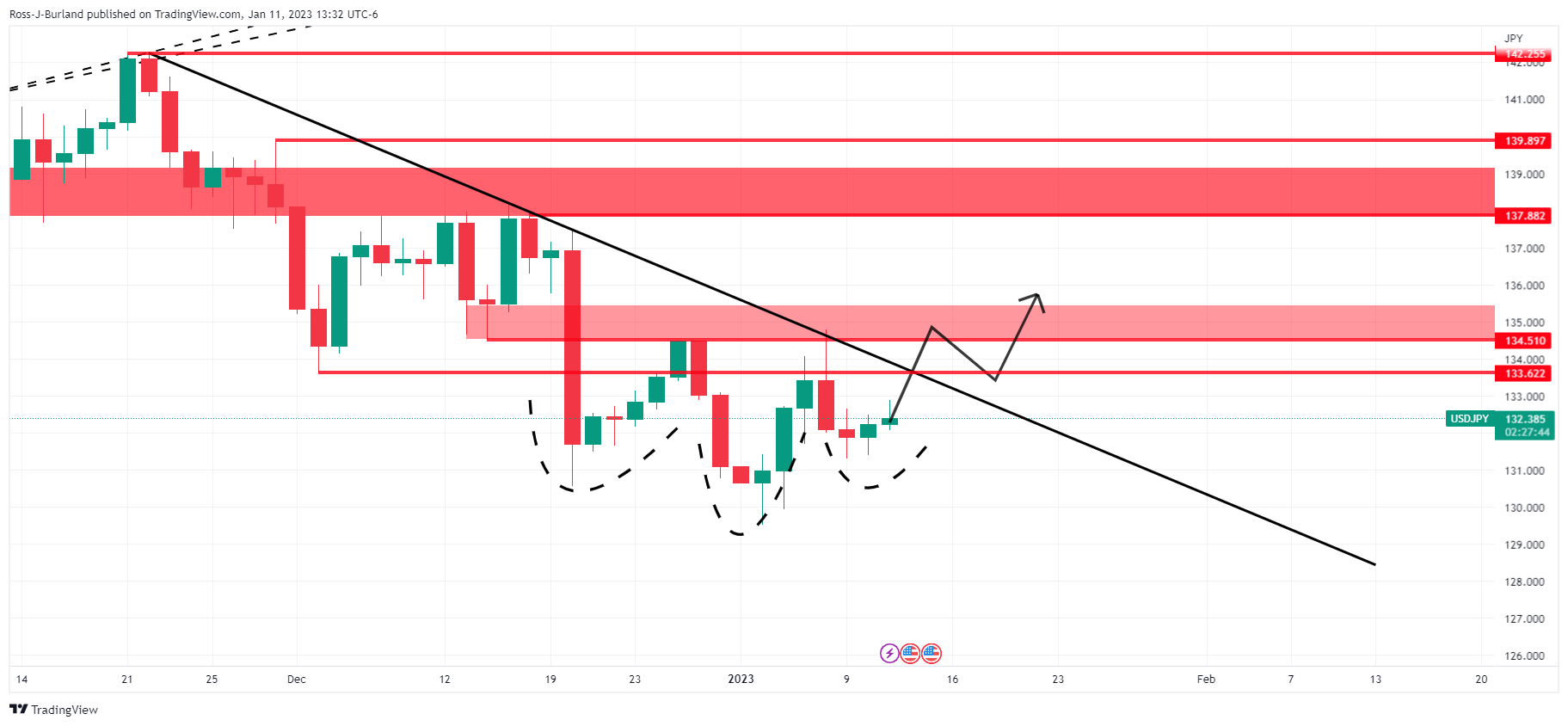

Meanwhile, as per the prior analysis, USD/JPY Price Analysis: Consolidation into US CPI, bulls on the prowl, the price remains inverse daily head and shoulders and there could be a reversal on the cards.

USD/JPY prior analysis:

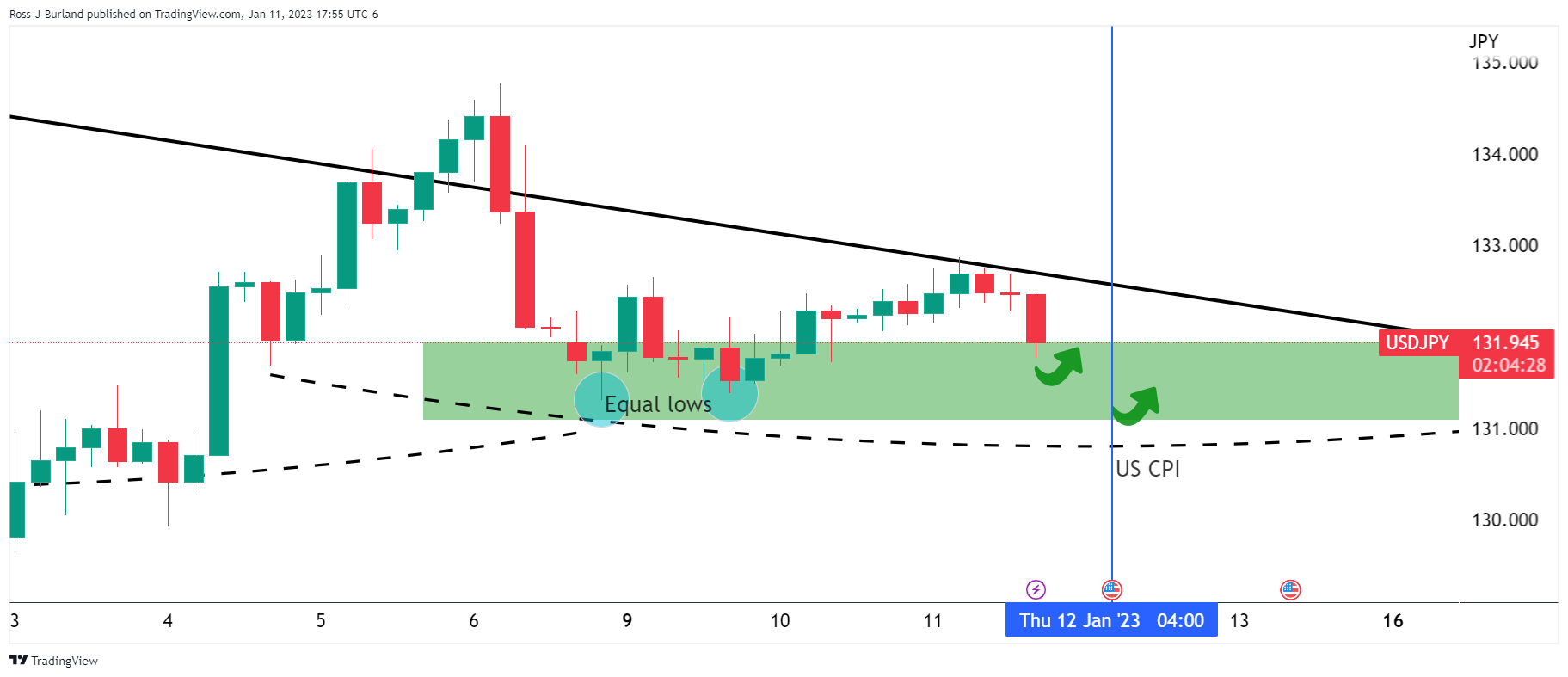

USD/JPY update:

On the 4-hour chart, we see the equal lows more clearly and on the hourly chart even more so...

As we head over to the US CPI event, the levels to watch are the 131.70s, 131.50s and 131.383 swing lows. There will be orders below these levels that could be traded before the reversal. With that being said, should the bears take control below 131.00 the bullish bias will flip bearish.

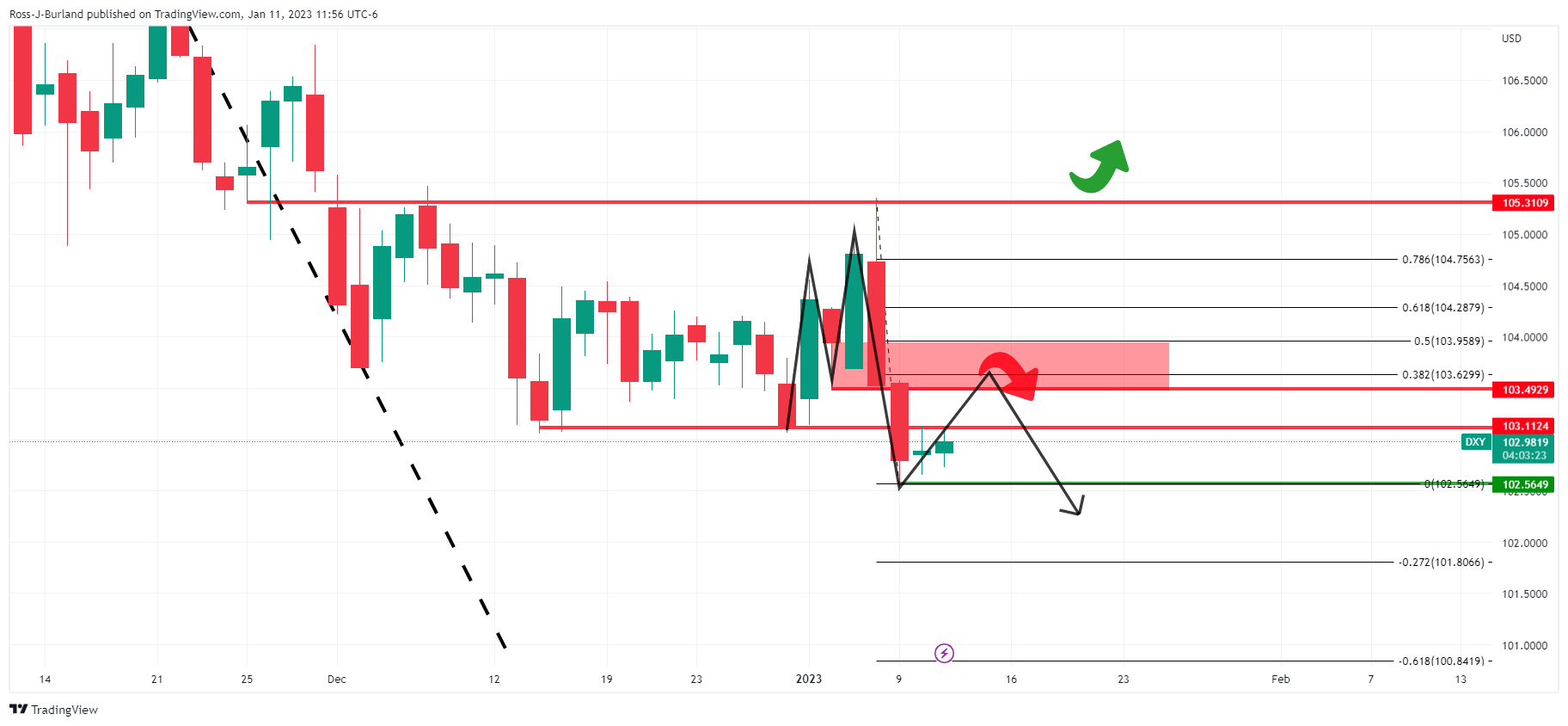

On the other hand, looking at the US Dollar, an M-formation is in play:

The M-formation is a reversion pattern and the price would be expected to move in for the restest of the resistance structures and neckline of the pattern between 103.50 and 104.00. Such a move would align with a 38.2% Fibonacci retracement and a 50% mean reversion at the extreme and be bullish for USD/JPY, playing into the head and shoulders thesis in the pair.